Credit Cards and Debt: How to Avoid the Financial Spiral?

According to the most recent data, debt in Quebec continues to rise among people of all ages, and a large portion of this debt comes directly from credit cards. While this financial tool offers some flexibility, it can also become a major source of stress when not managed properly.

With high interest rates on credit cards (and other loans and lines of credit) coupled with the constantly rising cost of living, it is becoming difficult—if not impossible—to make the required monthly payments.

Here is an article to help you understand why credit cards can become a trap, recognize the signs that you are over-indebted, and discover the legal solutions that can truly help.

Why Can Credit Cards Become a Trap?

Having a credit card may seem common because “everyone has one” and it is a convenient and attractive tool. It allows for quick purchases, rewards, and avoids the need to carry cash.

The problem is that this ease of use can also lead to impulsive spending and an accumulation of debt that becomes difficult to control.

Interest rates on credit cards are generally 19% and can even climb to 25% in some cases! If a person has $30,000 in debt, after a few years they will have paid several hundred dollars in interest just by paying the minimum amount each month. In the long term, they will have repaid two to three times the initial amount borrowed!

The real danger lies in the perception of credit card payments: as long as you can use it, you feel you still have purchasing power and the ability to pay. But when the card (or several cards) reaches its limit and monthly payments are very high, financial reality quickly catches up.

Signs of Imminent Over-Indebtedness

Recognizing the signs of over-indebtedness in time can save you a lot of trouble. Here are some indicators to watch for:

You only pay the required minimum each month: This means you are hardly paying off the principal and your debts are accumulating.

You use one credit card to pay the minimum of another: This strategy is a clear sign that your debt ratio is becoming too high.

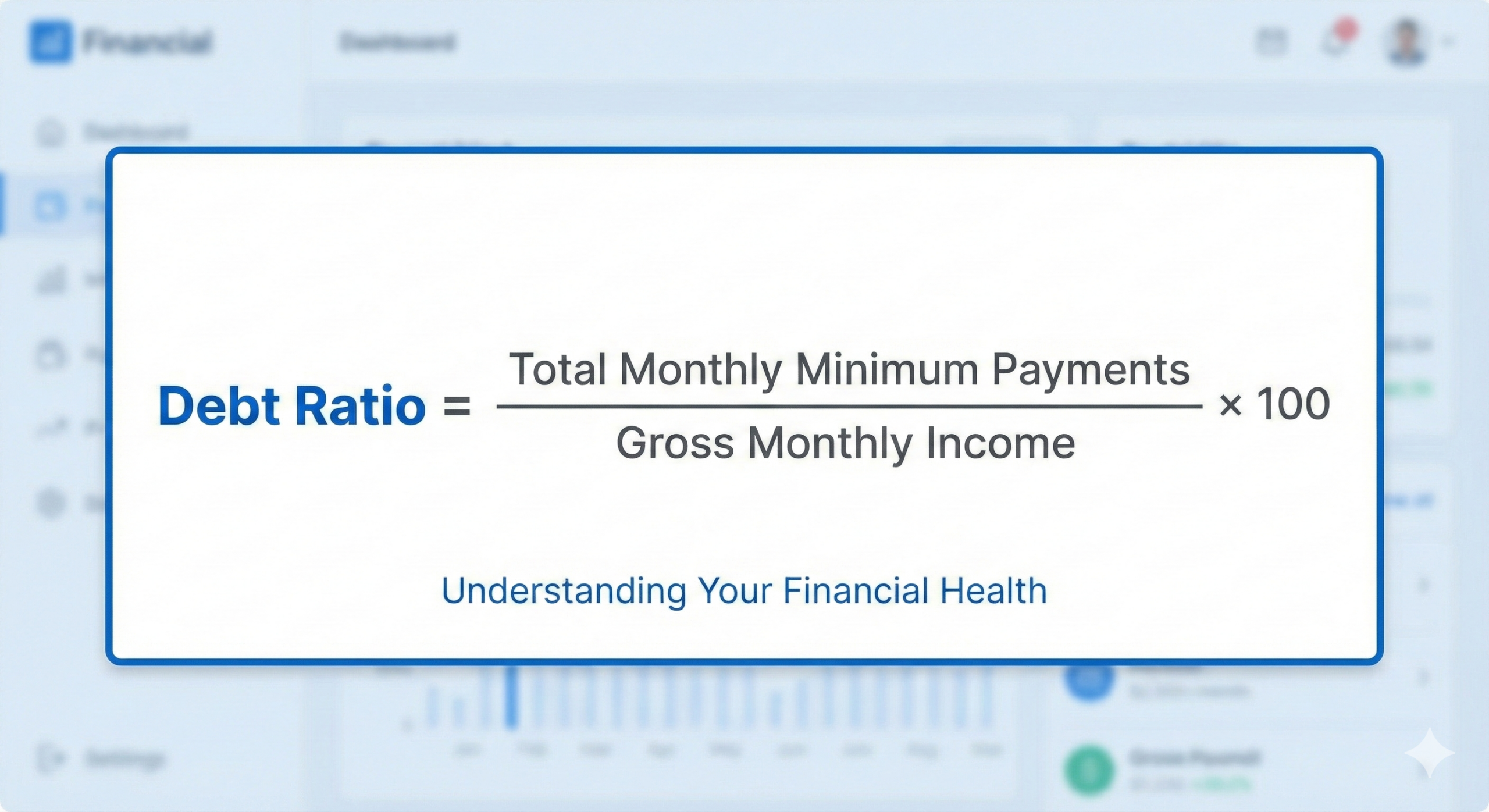

Your debt ratio exceeds 40%: This ratio measures the portion of your monthly income used to repay debts. If the amount is more than 40% of your income, it is not considered a balanced ratio.

To calculate your ratio, add up all your minimum monthly payments (loans, credit cards, etc.) and divide the total by your gross monthly income. Multiply this result by 100 to get a percentage:

You avoid checking your balance or paying it: This avoidance reflex is a sign that you need a tailored solution to resolve your debt problem.

Your payments are late: A simple oversight can happen, but frequent delays indicate uncontrolled debt.

Mistakes to Avoid When You Are in Debt

When the situation becomes difficult, certain decisions can worsen the problem. Here are the most common mistakes to avoid:

Ignoring the situation: The longer you wait, the more interest accumulates and the more limited your options become (such as debt consolidation or a consumer proposal).

Multiplying loans to pay other debts: This only pushes the problem further down the road without solving it and is not considered responsible credit management.

Closing cards without a strategy: Canceling a card could hurt your credit score if not done at the right time.

Consulting an unqualified advisor: Only a Licensed Insolvency Trustee (such as Gobeil Syndic) can legally offer solutions recognized by law, such as a consumer proposal.

Possible Solutions Before It Is Too Late

To avoid bankruptcy, several legal and accessible solutions exist to regain financial balance.

Review Your Budget and Consumption Habits

The first step is to draw a clear picture of your income, expenses, and debts. Identify unnecessary expenses or those you can reduce. Even small adjustments (meals at home, unused subscriptions, impulsive spending) can free up several hundred dollars a month.

Consolidate Your Debts

Consolidation involves grouping several debts into a single monthly payment, often at a lower interest rate. This avoids managing multiple payments on different dates. You obtain a loan at a reasonable rate and maintain good discipline for your payments.

Negotiate with Your Creditors

Some financial institutions agree to reduce the interest rate or establish a repayment plan. However, these agreements are not always easy to obtain on your own and require good financial credibility.

The Consumer Proposal: An Alternative to Bankruptcy

If your debts become too heavy, a consumer proposal is often the best solution. It is a legal agreement designed to help consumers escape debt, administered by a Licensed Insolvency Trustee.

The proposal allows you to repay only a portion of your debts based on your ability to pay, without losing your assets. The monthly payment is reduced and spread over 5 years. Best of all, there is no more interest to pay!

Unlike bankruptcy, this solution protects your assets (even your investments) and ends collection calls. It allows you to start over on a solid foundation while repaying your creditors realistically.

For more information, visit our Consumer Proposal page.

Consult a Licensed Insolvency Trustee

A Licensed Insolvency Trustee is not there to judge you, but to help you find the most suitable solution for your situation.

During an initial free meeting (by phone, video, or in person), they will evaluate your financial situation, explain your options, and support you at every step of the process.

Make an appointment for a no-obligation discussion with our advisor at Gobeil Syndic. You can get answers to your questions and then decide if a consumer proposal could be an advantageous solution to reduce your debt.

Have questions? Call us: (514) 839-0132